o Donald Trump is the new Most Powerful (Elected) Person In The World, and gets the keys to 1600 Pennsylvania Avenue. He celebrated, oddly, by playing the Rolling Stones’ You Can’t Always Get What You Want and giving a surprisingly civilised speech. The FTSE immediately started to fall, Canada’s immigration website crashed, and the Russian Parliament “erupted into applause”, according to the BBC.

It’s the latest chapter in a let’s say strange year, and means that economic and political uncertainty is likely to be the new normal on both sides of the Atlantic.

Given the reliance of the UK’s luxury property industry on dollar buyers – Hamptons recently found that 6% of buyers in Prime Central London were from the US in Q3 this year, and Fine & Country reports a 23% increase in the number of US website visitors between Brexit and today in comparison to the same period last year – and the global high net worth community, there will inevitably be effects on the prime residential sector. It may mean an end to the “Brexit discount”, which has made British property up to 20% cheaper for buyers with dollars, or it may cause a short-term flood of American’s fleeing to Blighty…

Obviously no-one really knows what may come to pass over the next year or four, but here’s what some key players in the UK’s prime resi industry are thinking…

Global investment into PCL property is likely to increase from investors who hold the view that Trump is risky for the markets

Camilla Dell, Managing Partner at Black Brick

“Following the victory of Donald Trump in the US election, we will almost certainly see market turmoil and weakening of the dollar. As a result, global investment into Prime Central London property is likely to increase from investors who hold the view that Trump is risky for the markets. Indeed, we are already seeing a flight to safe haven assets such as gold this morning and PCL property has always been seen as a safe haven asset in turbulent times.

“We are also likely to see some wealthy US citizens, particularly those most offended by Trump, move to the UK as some of our American clients hinted to us prior to this outcome. Foreign buyers, particularly those from the Middle East and of Muslim faith, may enter the London property market, too, as they decide not to buy property in the US due to his remarks about banning Muslims from entering the country.”

On balance it should be positive for the UK property industry

James Wyatt, Director at Parthenia

“The forgotten masses have spoken again and triumphed over the wishes of the establishment and Donald Trump has been propelled to the White House. Republicans now control the presidency and both houses, but Donald Trump won without the support of the Republican party.

“Donald Trump is known as an anglophile and unlike President Obama has promised to bring the UK to front of the queue for trade deals. He has also proposed spending on infrastructure, lower simplified taxes and to remove loopholes for the rich and companies. However, his rhetoric on immigration and foreign policy needs careful attention and it will be interesting to see if his position becomes more meted. What does all of this mean for the UK and PCL property? On balance it should be positive, as there may be an influx of dollar denominated buyers and an anglophile president may help the UK economy steer through the choppy waters of Brexit. Nunc dicam.”

We should see more Americans buying in PCL in the coming months

Alex Newall, Managing Director at Hanover Private Office

“Whilst the stock markets are quick to react, the property markets will be a little slower and buyers will place on hold their searches until the dust settles. This pause may bring a few short-term forced sells as loans expires due to failed sales. However, generally in the US prices should hold in the near term.

“Looking abroad, if Trump is to re-write global trade deals to increase US jobs and tax imports, we could see falls in the currencies of weaker economies. Currently with an historically cheap pound, now just might be the time to jump into UK property as borders tighten around the USA. Whilst we have already seen notional signs of USA buyers in the Prime Central London property market in recent weeks, we could see more emerging over the coming fairly soon. From disgruntled LA pop stars to the New York business elite hedging their bets, the west and east coasts who voted for Clinton maybe looking towards London as a good alternative. And why not? There are already many American Community Schools (ACS) here both in London and outside with the likes of ACS Egham near Wentworth and ACS Cobham near St George’s Hill – two American style gated communities.

“US Investment banks in London are numerous in the City and it’s generally a multi-cultural society which welcomes Americans. As ever, it’s just too early to tell what market movements will happen, but we should see more Americans buying in PCL in the coming months. Currently Belgravia is top of the list for one of our USA buyers.”

Central London’s property market is going to look increasingly attractive to those who fear the Trump effect

Louisa Brodie, Head of Search and Acquisitions at Banda Property

“Following this morning’s shock result in the US, London is waiting to assess what Donald Trump’s victory really means. With global stock markets currently in turmoil and the weakening of the US dollar, central London’s property market is going to look increasingly attractive to those who fear the Trump effect.

“We are likely to see US citizens, perhaps most of all those wealthy elite who were most offended by his campaign tactics, move to the UK now that the reality of the voters’ decision is sinking in. After a viciously fought campaign that has not endeared him to many around the world, particularly the Middle Eastern markets, London may now appear a far more attractive option to these buyers who had previously considered buying in the US.

“Banda has already seen an increase in US dollar buyers in central London since the Brexit vote in June and now we are going to see more Americans considering a move to London in the aftermath of today’s result.

“The recent fall in the value of sterling means there are even more attractive options available in the London market for buyers from across the Atlantic. With finance now cheaper than ever, perhaps we should be encouraging our American friends to head to London. West London in particular has been popular for Americans relocating with their families and our culture, legal and transport systems, language and educational facilities have always held an appeal.”

Financial markets might crash and the dollar weaken, effectively strengthening sterling

Gary Hersham, Managing Director and Partner of Beauchamp Estates

“I think it is likely that following the Trump win, the financial markets might crash and the dollar weaken, effectively strengthening sterling.

“It would therefore certainly help with pound based purchases in the US and Miami in particular, where unit prices in dollars per square foot are often below $1000, especially in off plan schemes with superb facilities such as The Missoni building in Edgewater, Miami.”

London will be high on the list for wealthy Americans keen to escape a Trump presidency

Nicholas Finn, Executive Director of Garrington Property Finders

“Prime London property has always appealed to the global elite as a safe haven investment and a political port in a storm. With America experiencing its own Brexit moment, and the weak Pound making UK prices highly attractive to dollar buyers, London will be high on the list for wealthy Americans keen to escape a Trump presidency.

“Chelsea, Kensington, St John’s Wood and Richmond already have sizeable US contingents and are likely to attract many of the newcomers. However it’s worth remembering that many US expats moving to London choose to rent rather than buy, so an American influx is likely to trigger rent rises as much as price rises.”

There will be a net positive impact on the market as investors retrench to blue-chip tangible assets

Naomi Heaton, CEO of London Central Portfolio

“There will be a net positive impact on the market as investors retrench to blue-chip tangible assets as uncertainty on the political and economic stage is heightened once again.

“Jitters in global equity markets driven by widespread speculation will be countered by flights to safety, with gold, the Yen and Swiss Franc set to benefit. Whilst the result will likely move the global spotlight away from Brexit, repercussions may be felt across Europe with the prospect of anti-establishment votes becoming keener. At the same time, the likelihood of the UK Parliament thwarting the people’s mandate to exit the EU has dwindled.

“Whilst all of this plays out, Prime Central London property, a traditional safe haven, is expected to benefit from a similar flight to quality, asset-backed investments.”

Our initial reaction to the US Election result for the UK property market is favourable

Charles Curran, Principal at Maskells

“Our initial reaction to the US Election result for the UK property market is favourable. Sterling has strengthened against the USD by 0.32% this morning which, notwithstanding a potential hike in the US in December, may start reducing some of the post BREXIT inflationary pressure in the UK. This is good for mortgage payers as it reduces the likelihood of the BOE’s hand being forced to increase rates to counter a strong dollar; the currency in which many of imported products are priced.

“Furthermore, this morning we saw that the Canadian immigration website crashed as US citizens sought to acquire Canadian citizenship. This bodes well for the UK, as it is one of the only other fully English speaking countries within financial market time zones and it is really those with country transposable skills (who can work anywhere) who may decide to make the move. London would make more sense than perhaps Australia or New Zealand, the other alternative being Hong Kong where property prices can be much higher than London.

“BREXIT may well have been a block to any moves by US Citizens, but in all likelihood, Parliament will be voting on Article 50 and will temper the hard Brexit line taken by the Government, which increases our chances of staying in the single market (most likely as part of the EEA), which we hope will allow for the continuation of pass porting financial service into the EU and access to the Single Market.

“Whilst we seen Americans buying all over London, there is a preference for St John’s Wood, Kensington and Chelsea due to the American Schools. However we have also seen more Americans put their children into British schools, so our advice would be to buy in an area with low debt levels, to protect their capital from any market volatility as a result of BREXIT.

“We may not see an immediate move, as President Elect Trump’s transitional team start their work, but already the markets have reacted badly. However, our view is that there may be a small knee-jerk reaction to his win, but if Americans are to move to the UK in significant numbers, it will be after he has taken office and established what the relationship will be like between the Republican House and Senate.”

The trend of Americans looking to swap the US for the UK has been building

Martin Bikhit, Director at Kay & Co

“With no language barrier, London and the wider UK is hotly tipped to be a location of choice for those leaving Trump’s domain. There would be no real culture shock and, despite the UK’s vote to leave the European Union, those Democrats leaving the US may find living under the remit of new left-wing Mayor of London, Sadiq Khan, more politically palatable. The world also perceives Teresa May, the longest serving Home Secretary for 50 years, and the new Prime Minister, as a safer pair of hands than the celebrity-cum-political Donald Trump.

“The trend of Americans looking to swap the US for the UK has been building as the combined factors of the US election and the weak sterling make such a global and unique city as London very attractive.”

Donald Trump’s win makes the potential effects of Brexit look like a garden party

Tim Macpherson, Head of Residential for Carter Jonas London

“As the world takes stock of Donald Trump’s election to President, we expect to see a movement of affluent Americans from major cities across the US into Prime Central London. The pound remains attractive to dollar based buyers in the wake of Brexit, who still see relative market stability in London, and as a result, view it as a place to invest their money in property. Keen to shelter from any ensuing political and economic upset, a number of buyers registered with us in advance during the presidential campaign, with a view to progressing their purchase following a Trump victory. Now that has happened, it is likely that a number of them will follow-up on their initial interest.

“We anticipate a potential power shift between New York and London, with a new wave of professionals,originating from Hong Kong, Singapore, Malaysia and even Tokyo, as well as investors from the Middle East, now looking to do business in alternative locations to the US.

“Although Donald Trump’s win signifies an unprecedented change in the political landscape that makes the potential effects of Brexit look like a garden party, London’s prime market is set to benefit – such is the attraction of our capital city and its place in the global economy. However, rather than relying on American based buyers for an improvement in the London market, perhaps our more immediate aspiration should focus around an SDLT reduction in the Autumn Statement.”

The surprise of last night’s result will be likely to be replaced by a more considered view of the implications of the new presidency

Liam Bailey, Global Head of Research at Knight Frank

“There may be a period of instability in currency markets, which will influence some short-term decision making around asset allocation.

“However, rather like the Brexit vote in the UK the surprise of last night’s result will be likely to be replaced by a more considered view of the implications of the new presidency.

“It is important to remember that almost alone of all developed economies the US has largely shaken off the impact of the global financial crisis and has led the way to improved economic growth.

“The business environment in the US and innovation in business services and technology providers based in the US have helped to drive property market demand globally – it is an incredibly strong platform to build from.”

The domestic property market particularly outside of Prime London won’t be affected

Ian Westerling, Managing Director of Humberts

“The Trump win will cause short term stock exchange fluctuations affecting buying decisions at the top end however we predict that it’ll be business as usual in the UK over the coming weeks. The domestic property market particularly outside of prime London won’t be affected – we’ve already seen our sales increase by around 5% on the same time last year and we expect that continue as we head to the end of 2016.”

Our fear is that the value of the dollar will fall… hence London will lose its attraction to overseas buyers

Matthew Kaye, Partner at Kaye & Carey

“Our fear is of course that the value of the dollar will fall to such an extent that it wipes out the advantage any dollar based economy has been enjoying against the pound – hence London will lose its attraction to overseas buyers as place to invest.

“One possible upside might be that high net worth American citizens decide to flee the US and settle here instead.”

This result could sway buyers to favour a London purchase instead

Simon Tollit, Central London sales director at United Kingdom Sotheby’s International Realty

“We have definitely seen an increase in US purchasers looking to buy in and around Prime Central London over the last six months. Whilst the impending election was causing concern for some, it is more likely this was being driven by the weak pound rather than the election results. It is possible this interest from US purchasers may wane as we have already seen the pound make strong gains against the dollar following the vote, with these currency shifts in mind we expect other foreign buyers to look to the London property market as a consistently safe investment. Investors do not like to buy in uncertain markets and a win for Trump means a change of party, meaning changes in policy are far more likely with a Clinton defeat. New York and London are historically rival property markets, meaning this result could sway buyers to favour a London purchase instead.”

Trump’s victory may well prove beneficial for the UK property market

Jean Liggett, CEO of UK-based Properties of the World

“The US economy remains the force that sets the pace for the rest of the world. Even with the rise of China and the growth of other emerging markets, America is still the strongest economy in the world.

“Donald Trump’s US presidential election victory raises concerns over the impact of this outcome for global economies, including that of the UK. Today’s Trump victory is likely to cause market trepidation around the world. Many companies and investors may look to move their investments and companies, at least in part, out of the US to safer havens.

“Trump’s election could generate a significant movement in the US dollar and potentially jeopardise US diplomatic relations across the world.

“However, Trump’s victory may well prove beneficial for the UK property market, as investors seek to migrate their portfolios from the US to a more secure and predictable market – the UK. This may even mean that the sterling could rise in value. Under Trump’s stewardship, ‘predictable’ may need to be removed from the US English dictionary for the next four years. Only time will tell how the US property market – and others around the world – respond to his election victory.”

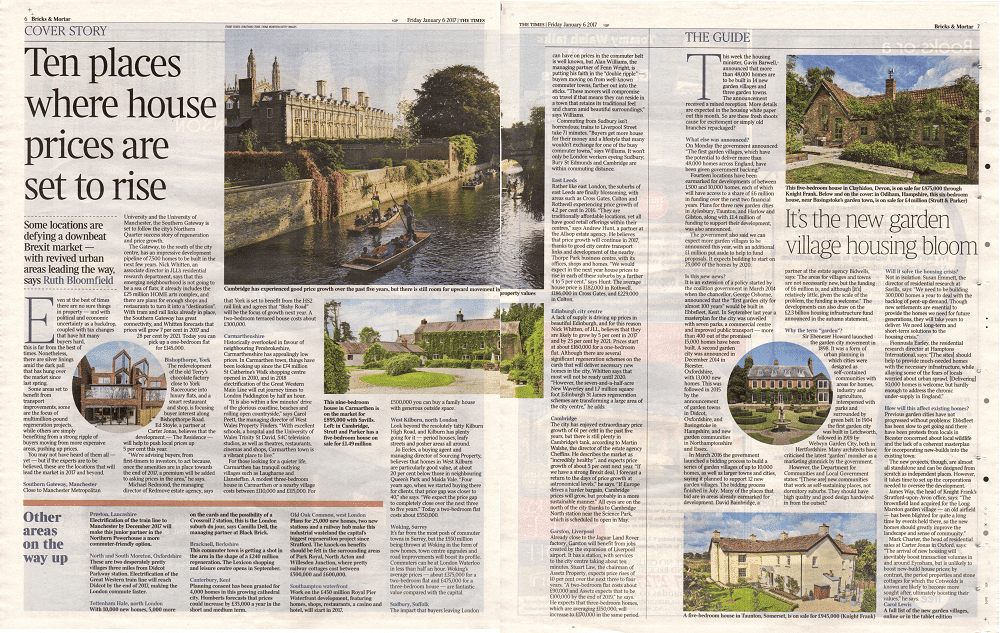

Some locations are defying a downbeat Brexit market — with revived urban areas leading the way even at the best of times there are no sure things in property — and with political and economic uncertainty as a backdrop, coupled with tax changes that have hit many buyers hard, this is far from the best of times. Nonetheless, there are silver linings amid the dark pall that has hung over the market since last spring.

Some locations are defying a downbeat Brexit market — with revived urban areas leading the way even at the best of times there are no sure things in property — and with political and economic uncertainty as a backdrop, coupled with tax changes that have hit many buyers hard, this is far from the best of times. Nonetheless, there are silver linings amid the dark pall that has hung over the market since last spring.