The residential lustre of London’s grandest quarter is once again gleaming, says Lisa Freedman, sparked by a £500m investment from the Crown Estate and myriad redevelopments that are stealing Mayfair’s limelight

When Prince William was invited to join the Turf Club, the renowned gentlemen’s club in London’s St James’s, its members were not exactly delighted. The second in line to the throne was, of course, a welcome addition to its hushed salons, but the club, like the area in which it sits, prizes itself on discretion. The potential for paparazzi at its gates was not considered desirable.

“St James’s is still a bit of a secret,” says entrepreneur Peter de Savary, whose wife Lana is one of a rarefied list of “developer-designers” currently paying close attention to its elegant streets. “It feels very English, and is one of the few areas left in London where you can still find some very special properties.”

St James’s is, in fact, the capital’s grandest quarter. Here, for more than three centuries, those with a country estate or a seat in Parliament, have found a home away from home in London’s “clubland”. At the Turf (with more than its fair share of dukes), or White’s (with its powerful supply of Tories), at The Athenaeum (where Trollope wrote his Barchester novels), or the Reform (where Burgess plotted with Maclean), governments were formed and fell, idle hours were pleasantly passed and the wastrel sons of Britain’s noblest houses gambled away the family fortunes.

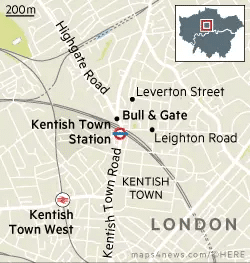

Framed by Pall Mall, Piccadilly, Green Park and Haymarket, the area is also home to Fortnum’s and The Ritz, to royal warrant outfitters such as Turnbull & Asser, John Lobb and Lock & Co, and to a distinguished array of vintners, barbers, cigar shops and galleries – all of which provide the daily necessities for the English gentleman. As far as residential property is concerned, until recently, St James’s has remained something of a backwater, offering little in the type of deluxe development that has defined the market in Knightsbridge, Belgravia and Mayfair. Now, there has been a decisive shift in mood.

“St James’s came onto the radar about 18 months ago, when developers began to realise it was seriously undervalued,” says property-search agent Camilla Dell, managing partner and founder of Black Brick. “Today, the word is definitely getting out.”

Although the borough of Kensington and Chelsea is graced by royal patronage, St James’s can lay far greater claim to a regal association. The brainchild of one of Charles II’s Lord Chamberlains, Henry Jermyn, 1st Earl of St Albans, it began in the mid-17th century as a scheme for three or four large mansions along the lines of Paris’s hôtels particuliers. But the devastating effects of the Great Fire of London led to a rush on land west of the City, and St Albans upped the number of plots to 22, selling off some to his fellow noblemen, among them Lord Arlington and Lord Halifax, and others to developers. In so doing, he became “the Father of the West End”.

St James’s link with royalty remains strong. Not only is it within a 10-minute stroll of Buckingham Palace, but a key landlord here is the Crown Estate, whose revenue is paid back into the Treasury each year for the benefit of the public finances. The Crown’s decision to embark on a £500m investment programme to develop its £2.2bn holding of residential and commercial property, and improve public areas within St James’s, may have been the catalyst for much of the renewed interest.

“As a major landholder in St James’s, the Crown Estate is able to take a long-term approach,” says James Cooksey, who heads up the portfolio. “Our aim is not to change St James’s, but to refine it.”

The Crown is currently involved in seven major mixed-use developments, which will ultimately add a further 62,000sq ft of living space. Of these, the first to be completed, St James’s Gateway, fronting Piccadilly and Jermyn Street, was completed earlier this year. Designed by award-winning architect Eric Parry, the residential component, at One Eagle Place, sold promptly, with only two apartments remaining for sale, one of which is a two-bedroom, fourth-floor flat – still on the market with Strutt & Parker and WA Ellis, at £4.15m.

Elsewhere in St James’s, 3 Carlton Gardens – bought last month for £65.5m by Michael Spink (developer of Britain’s most expensive house), working with the private equity group Evans Randall – is undoubtedly the most impressive.

Carlton Gardens terminates the western end of Carlton House Terrace, the stucco-fronted palatial stretch fronting the Mall designed by Regency maestro John Nash, whose other works include Regent’s Park and the remodelling of Buckingham House into the palace. The terrace has been home to three prime ministers (Grey, Palmerston and Gladstone) and a host of other political celebrities: No 3 was the wartime residence of Charles de Gaulle.

In the mid-20th century, there was talk of pulling the terrace down, as it was thought there was little demand for London houses of this imposing scale. Now, of course, the appetite for magnificence has returned and, no doubt, the refurbished No 3 – which, as well as having commanding views over St James’s Park, will have a series of nobly proportioned reception rooms, six bedroom suites, a spa, underground parking facilities and a private garden – should have very little difficulty finding an appropriate purchaser.

“This won’t just be an elegant town house,” says Mark Dorman, head of London residential development at Strutt & Parker. “It’s grand on an epic scale.”

A significant proportion of the current wave of development has been made possible by the transfer of former office space to home use, and the Walpole – five individually designed apartments created from a Georgian town house in Arlington Street – have benefited from this new freedom. Once the home of Britain’s first prime minister, Robert Walpole, the building, which faces onto The Ritz, set a new high for price per square foot in both Mayfair and St James’s, according to Joe Burns, MD of Oliver Burns, the architectural, interior design and development practice responsible for the building. “Mayfair has been more in the limelight in the past few years,” he adds, “but St James’s offers our investors greater opportunity for growth.”

For international buyers at the top end of the market, the Walpole clearly fulfilled an unmet demand. “If a very wealthy buyer turns up in London at a moment’s notice and wants to see a super-prime development, there’s often little to show them,” says Simon Barry, head of new development at Harrods Estates, which is currently letting an apartment in the Walpole for £6,500 a week. “Last year, the Walpole was the only development in Mayfair and St James’s that met their criteria.”

What the Walpole proves beyond doubt is the demand among both British and international buyers for large, lateral spaces luxuriously converted to the highest standards. St James’s House, at 88 St James’s Street, will be a further addition to the ranks of offices converted to residential space. The former offices of the Alliance Assurance Company, it was bought last year by the Carlyle Group and will soon provide apartments – ranging from 1,000 to 10,000sq ft – behind its classical façade. These will be accompanied by the crucial draws of on-site parking, a purpose-built spa and concierge services. Prices, on its completion in 2015, will start from £20m through Strutt & Parker and Christie’s International Real Estate.

“For international buyers, the royal connection and the level of security are obvious attractions,” says Mark Dorman, who is selling the apartments jointly with Christie’s IRE. “This will be one of the closest private residential developments in London to Buckingham Palace and will have the Household Cavalry, Life Guards and Blues and Royals marching past the doorstep. What could be more reassuring than that?”

You can generally tell a neighbourhood is on its way to the pinnacle by the presence of the Candy brothers, who have set a world standard with their work at One Hyde Park. In St James’s, they have taken rooms over the fashionable Wolseley restaurant and transformed them into the sort of sophisticated, indulgent living space appreciated by their extremely wealthy clientele.

“St James’s is the younger and more discreet cousin of Mayfair,” says Nick Candy, CEO of Candy & Candy, “and it’s experiencing a resurgence as one of the most exclusive residential areas in central London.” The five‑bedroom duplex Penthouse, which has a main reception room with a total area of 1,237sq ft and panoramic views of the Houses of Parliament and the London Eye, is on the market, through Knight Frank, at £42m. On Arlington Street, it has its own accommodation for staff, but one of the important factors for international buyers, many of whom are often only temporarily in residence, is having help conveniently to hand. Buyers at Lana de Savary’s development, 46 St James’s Place (for sale through Savills and Knight Frank from £3.5m), are being offered an inclusive concierge service for the first year with Quintessentially, while residents of the Walpole can apply to join The Ritz Club, for use of its services.

Increasingly, however, those who come to London in short bursts aren’t here to lounge about at home, and the Crown, which in its 20-year, £1bn regeneration programme of Regent Street (begun in 2002) has built up a considerable reputation for importing big-name brands, is doing much the same in St James’s. One of its recent coups is the addition of Michelin-starred chef Angela Hartnett, whose new restaurant, Café Murano, opened at 33 St James’s Street in November, on the former site of Gordon Ramsay’s Pétrus, where she used to work. “It’s thrilling to open a restaurant where I trained at the beginning of my career,” she enthuses. Appropriately understated and classic, it will certainly be a cut above typical London club food.

“St James’s has been like Mayfair was 10 years ago,” says Mark Dorman. “You would come here at weekends and it would be dead. Now it’s becoming a really exciting place to be.” And, of course, to live.