Publication: The Financial Times

The price is right: a guide to valuation

With so much advice available, how should vendors decide who to listen to? We outline the factors to consider

By Francesca Steele

January 12 2018 – The Times

This five-bedroom house in Broadway, Worcestershire, is on the market for £1.9 million with Savills.

The old adage goes: “There is no such thing as a bad property, just a bad price.”

A sharp slowdown in house price growth last year, along with several reports of sellers dropping asking prices in central London, means that many homeowners may be wondering how to price their house sale correctly. Should you listen to your estate agent, or look at house price indices? How much more should you expect buyers to pay for your designer kitchen?

“The key is research,” says Caspar Harvard Walls, a partner at Black Brick, a buying agency. “There are some estate agents who are desperate for stock, and so will value a property high so that they can get it on their books. All too often the overpriced property is then used as a ‘lever’, whereby agents will show it alongside more accurately priced alternatives in a bid to make them look cheap. This does not help the owner, and they will have to bring their price down.” We answer your pricing questions.

What do the house price indices say? Research from Nationwide shows that house prices rose by 2.6 per cent last year, compared with growth of 4.5 per cent in 2016. London was the worst-performing region, with house prices falling 0.5 per cent last year. Meanwhile, prices in the West Midlands grew by 5.2 per cent, and in the East Midlands by 4.6 per cent.

In Chelsea, west London, this five-bedroom home is on sale for £27.5 million.

Regional disparities could also be significant this year. Savills forecasts a further house price fall of 2 per cent in London this year, and growth of only 0.5 per cent in the southeast and east of England. Over the next five years the estate agency predicts growth of 7.1 per cent for London, compared with a rise of 18.1 per cent for the northwest and 14.8 per cent for the West Midlands.

How can I tell how much my house is worth?

Don’t look solely at property portals, as these will tell you the prices that sellers are asking, not what they are achieving. “Get the opinion of three local agents,” says Christian Warman, a director of Tedworth Property. “Often people opt for the middle valuation. There is logic to this, but also ask each agent to demonstrate how and why they’ve come up with the price they have given. If they can’t justify it, alarm bells should be ringing.” Compare the agents’ valuations with sold price data on Rightmove, which shows the latest Land Registry figures. David Lee, the head of sales at Pastor Real Estate, says: “Do some research into what has sold in your area and a radius of five streets within the past six months.” Alex Newall, the founder of Barnes Private Office, says: “Don’t look at Rightmove or Zoopla’s approximate pricing of your house. They are mostly incorrect.”

Should I under price?

It depends. Round numbers pick up people searching online for different price brackets. “Gone are the days of pricing just under or over a price point — say, at £499,950 in favour of getting £500,000,” says Tim Simmons, the head of residential sales at Humberts. “Vendors will render themselves invisible to those looking in the £500,000 to 550,000 price point.” Vendors keen to sell quickly are often advised to drop down a price bracket and add “offers in excess of”.

Should I factor in higher stamp duty?

Absolutely, says Alexander Lewis of Knight Frank. “Anything above £1 million is being down-valued because of higher stamp duty [since it went up in 2014]. Buyers expect sellers to factor at least 50 per cent of [the loss] into their pricing.”

Does my location matter?

Yes. Lewis says: “Not only should you think about what is selling in your neighbourhood, but what makes your house worth more than the neighbourhoods near by.”

Prime southwest London properties have experienced a decline in prices over the past year, according to Savills. Property prices in Battersea, Clapham, Fulham, Wandsworth, Barnes and Richmond fell by an average of 4.2 per cent last year, making it London’s weakest prime market. Regional city markets are likely to hold their value, but check out the competition.

So what is likely to alter the value of my house?

Transport links are key (including imminent ones, such as Crossrail), as are good local schools. Agents say that buyers are happy to pay more for completed works that add structural value, such as a loft conversion or extension, but not for expensive cosmetic changes such as a new kitchen. “If something has been on the market for six months or more, even if you are getting lots of viewings, you may want to reconsider the price,” Lewis says.

A Knightsbridge flat for £10?

Agents are using novel marketing to ride the downturn in prime London property

Harrods on Brompton Road, Knightsbridge © Getty

Knightsbridge isn’t usually somewhere to shop on a budget but this year one lucky home hunter might pick up a three-bedroom apartment on Walton Street — valued at more than £3m — for £10.

All he or she need do is beat a few hundred thousand other hopefuls in a cricketing “spot-the-ball” competition. As well as a share of the freehold, the winner of the property will have stamp duty paid and receive a matte-black Jeep.

“It’s a sexy house,” says Santa Agolli, founder of Your Laddr, which is organising the competition. “It’s next to Harrods, it’s a dream lifestyle.” This property event is launching her business: Your Laddr will eventually offer a range of homes through the same form of competition.

“For 10 quid, why not have a go?” asks Noel De Keyzer, director of Savills’ local office. The average sale price of Knightsbridge flats in 2017 was just over £3m, with houses close to £5m, according to data from LonRes. The 1 in 380,000 chance offered by Your Laddr might be more appealing than ponying up the actual costs.

“So long as the scheme involves a sufficient element of skill, judgment or knowledge, ‘spot-the-ball’ competitions can operate lawfully in the UK without the need for an operating licence,” says David Copping at Farrer & Co, the law firm. He adds, however, that if prizes can be awarded on the basis of pure luck or guesswork, the competition is likely to be subject to regulation by the Gambling Commission.

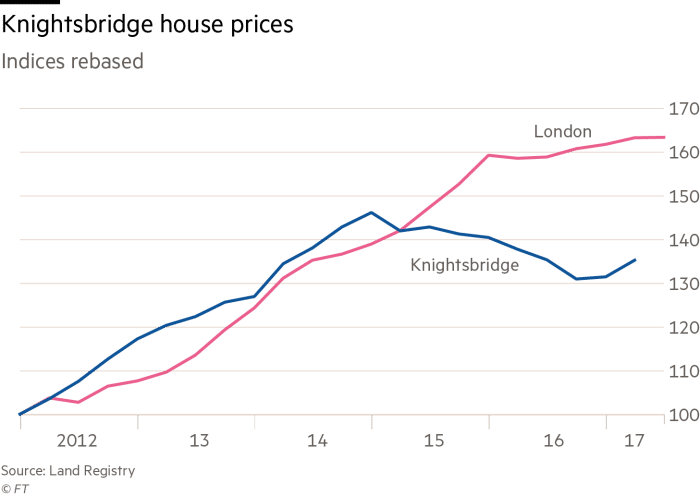

Local agents describe the competition as a gimmick, but vendors may be open to new ideas. Prices are down 15 per cent since 2014, according to LonRes, and homes that did sell last year spent an average of 157 days on the market, with 45 per cent having their prices cut.

Like other affluent London neighbourhoods, Knightsbridge has been hit by what De Keyzer calls “Osborne’s changes” — the stamp duty reforms introduced by the former chancellor, which first raised the bill on properties costing more than £937,500 and then added a 3 per cent premium to all second homes. “People have not adjusted to the changes we’ve seen over the past 18 months,” he says. “[The vendors] might not have been able to shift the apartment the conventional way.”

“As a buyer you can’t afford to make a mistake if you’re paying 10-15 per cent in stamp duty,” says Harry Dawes, head of Knight Frank’s Knightsbridge office. The caution has been palpable among Knight Frank’s customers: “At the peak of 2014 we were averaging 18 viewings per offer, now it’s around 45,” says Dawes.

Apartment on Walton Street, valued at £3.2m, which is the prize in Your Laddr’s ‘spot-the-ball’ competition © Frederick Ardley

“Our register in the Knightsbridge office has never been so low,” says De Keyzer. “We’ve seen transaction numbers at the top end [on properties valued at £5m and above] down by 40 to 50 per cent.”

Discretionary buyers have been discouraged by the stuttering market and many have become renters until confidence returns. Buying agent Camilla Dell has an alternative explanation: “Knightsbridge is not the desirable postcode it once was,” she says. “A lot of my clients say Knightsbridge has lost a lot of its gloss.” Even Middle Eastern buyers — so established in the area that Harrods is now an asset of the Qatari state — are venturing to the garden squares of Belgravia and Mayfair, she says.

Before the downturn, Knightsbridge had been on a streak. The area straddles Kensington & Chelsea and the City of Westminster — the two best-performing markets in the UK from 2005-2015, according to Savills Residential Research. During that decade, prices there rose 80 per cent or more.

One reason for the boom was a series of super-prime developments, such as The Knightsbridge, 201 residences near Hyde Park. Today, a one-bedroom flat in the development is on sale for £3.495m — more than £4,000 per square foot — with Harrods Estates.

The Knightsbridge was followed in 2011 by One Hyde Park, a Candy brothers development which launched at a headline-grabbing £6,000 per sq ft. “The reputation of One Hyde Park is still head and shoulders above anything else,” says Simon Barry, head of New Residential Developments at Harrods Estates. Dell is less flattering, describing it as “a goldfish bowl”.

The address certainly commands a premium, with a five-bedroom apartment marketed for £50m by Knight Frank. A number of apartments in the development are owned by offshore companies — at last count, it was reported that 20 have purchased homes there in excess of £20m.

Transaction volumes in Knightsbridge have fallen 36 per cent from 2014 levels, according to LonRes, and even a small bounce back last year, when some 26 more homes were sold than in the year before, has done little to raise morale among local agents. For now, finding a ball might be easier than finding a buyer.

Buying guide

-

Transaction volumes in Knightsbridge have fallen 36 per cent from 2014 levels, when 318 homes were sold, according to LonRes. In 2017, just 202 changed hands

-

Two-thirds of students at Imperial College in Knightsbridge are from overseas. Agents report an increase in buyers — particularly from China — looking for high-end student accommodation

-

Hyde Park barracks, home of the Household Cavalry, was earmarked for development, but failure to find a home for the mounted regiment stalled plans

What you can buy for . . .

£1m A one-bedroom flat opposite Harrods

£7.5m A five-bedroom penthouse in a listed building

£20m A four-bedroom new-build townhouse