25th October 2021

12mins

If the pundits and number-crunchers are correct it is not only fireworks that will be exploding into life this month.

London’s property market, much of which has spent the pandemic in a state of semi-hibernation, is starting to show distinct signs of life.

As office workers return to their desks, rents are increasing for the first time since the start of the pandemic, and sale prices have also started to inch upward.

What this means, in real life, is that buyers after a family house in a sought after area need to prepare themselves for a real bun fight over a limited supply of options. And we can’t see the imbalance between supply and demand resolving any time soon.

Asking prices in the capital increased by a decisive 1.9 per cent last month according to the latest research from Rightmove, pushing annual growth to 2.6 per cent.

While London’s annual growth figures do still trail the rest of the UK, its monthly performance is better than most other regions (only the North West and Wales saw bigger jumps, while the South West also saw 1.9 per cent growth), and it feels like a long time since the capital wasn’t bringing up the rear in property studies.

What this report suggests is that the main property forecasters – who concur that London’s property market will see significant price growth by 2025 – have done their jobs, and that anyone who owns a home in the centre of London or its leafy suburbs can expect some major capital appreciation over the next five years.

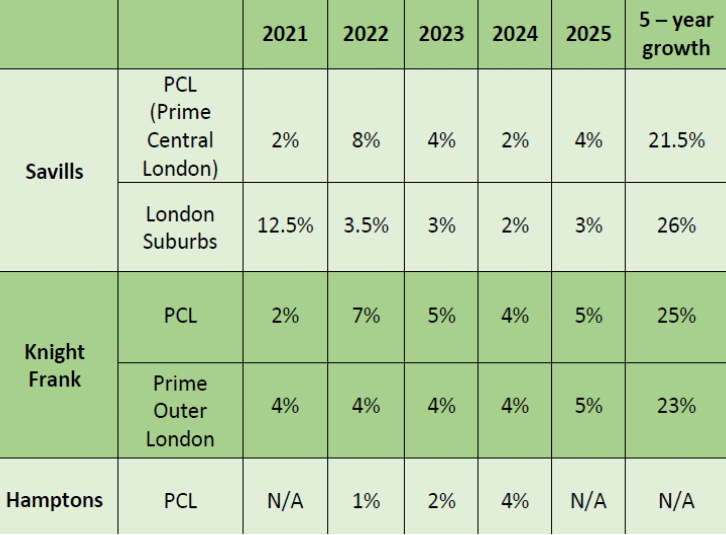

In forecasts made earlier this year Savills predicts that by 2025 prices in Prime Central London (PCL) will be up by 21.5 per cent, while London’s suburbs will see growth of 26 per cent. Knight Frank has forecast a 25 per cent price forecast in PCL and 23 per cent in Prime Outer London. Hamptons is expecting more modest growth across PCL.

Caspar Harvard-Walls, a partner at Black Brick, points out that London has been idling since the last peak in the market back in 2014, thanks to a succession of tax hikes, political and economic upheavals and, of course, Covid-19.

“London is still down around 20 per cent from the peak of 2014,” he pointed out. “That will spring back really quickly while we have low stock, really cheap money, and lots of competition between buyers.”

This competition will inevitably become more international as global travel restrictions loosen and Camilla Dell, managing partner of Black Brick, suspects that American buyers in particular will be eyeing the relative value for money in London.

“Record low interest rates, a continued favourable dollar exchange rate and the fact we have no annual tax on property here like you do in the US, all suggest London will be a focus for US and indeed many other international buyers,” she said.

What the pundits predict:

Average price data is of course a very blunt instrument when it comes to assessing the health of a property market in a city as huge and as diverse as London.

In certain locations a combination of an extreme shortage of stock, and strong demand for family homes with plenty of space, indoor and out, is fuelling competitive bidding and record prices.

St John’s Wood, in north London, is very much one of those hotspots – its combination of proximity to the centre of the city, a thriving high street, and some of the most beautiful period houses in the capital has turned its streets into something of a property battlefield.

“House prices have risen in excess of ten per cent in the past 12 months,” said Camilla Dell, managing partner of Black Brick.

The stress here is on the word “house” – flat sales are not nearly so buoyant – and Dell said that even unmodernised homes on good streets have breached the £3,000 per sq ft mark, currently changing hands for £3,200 to £3,300 per sq ft and competition is fierce.

“I would go as far as to say that it is impossible to buy in one of these very busy markets without a buying agent,” said Dell.

“A lot of the clients we are taking on at the moment are people looking in the £4m to £10m bracket and they just can’t find anything to buy or they find something and then get gazumped.”

Harvard-Walls said that conditions are similarly tough in other sought after suburbs like Putney. “We showed a house in Putney to a client on a Friday, the day it went onto the market,” he said. “They didn’t want it, but within two days the vendor had an asking price offer and one of over asking price. It was gone in two days.”

Buyers certainly don’t seem to be shying away from hefty price tags – London’s top end homes are having their best year for sales since 2015 according to a report by Savills. It found that 352 homes have sold for £5m or more in the first nine months of the year (compared to 319 throughout 2019). And almost 100 homes have sold for more than £10m, the majority to people already based in London but keen to upsize post-pandemic.

A key factor underpinning the strength of prices across the UK is the sheer lack of supply of homes – whether it be a lovely lateral family house in prime central London, a sea-view bolthole in Cornwall, or a dreamy Cotswolds country cottage.

Dell believes that what we are seeing is a vicious circle in action. “Sellers are not sure about selling because they don’t have anywhere to move on to,” she said. “They know they can get a great price for their property, but they don’t want to sell and rent for a while because they fear that the market might run away from them.”

There have also been scare stories of vendors selling up in order to become cash buyers and then finding that not only can they not find a new place to buy but even renting a short term home is a challenge. In some cases families have found themselves moving from one Airbnb to another for months while trying to find a more long term solution to their living arrangements.

The demand/supply imbalance is particularly acute in London where Knight Frank says the number of new prospective buyers registering in the third quarter of this year was 27 per cent above the average for 2015 to 2019 average. There are, on average, 13 buyers registered for every home on the market.

The papers have been full of speculation about the likelihood that, with the price of everything from property to petrol and pizza on the rise, the Bank of England will hike the base rate soon.

This will have a knock on effect on the cost of borrowing, and the aim of the exercise is to dampen down consumer spending and bring inflation under control.

Right now, with the base rate at 0.1 per cent buyers can get fantastically cheap mortgage deals – those with a deposit or equity of 40 per cent can find two or five year fixed rate deals at less than one per cent.

The likelihood is that any increase will be small and incremental and while it might make a difference to first time buyers looking for a modest starter home Harvard-Walls feels that in London the point is likely to be moot.

“Borrowing is still going to be very cheap,” he said.

A bigger issue, of course, is tax. “It is now so much more expensive to buy and sell a property than it was in 2014 and I think that is really impacting on people’s decisions,” he said.

Only the hardiest of readers will not yet have succumbed to their central heating, in a year where record energy bills are going to be metaphorically falling onto our doormats.

The Government is very keen we start to green our homes, to save the world as well as our pockets, with plans to phase out gas boilers and pressure on to retrofit old houses with better insulation.

A fascinating report by the Energy Efficiency Infrastructure Group found that only 13 per cent of UK house buyers consider energy efficiency when choosing a new home. This figure leaps, however, to 26 per cent in London. Central London is also, and probably not coincidentally, the electric car capital of Britain; 4.3 per cent of vehicles in Westminster are either electric or hybrid. The City, Camden, and Kensington and Chelsea, also have high rates of eco-car ownership. Lucian Cook, head of residential research at Savills, believes an element of environmental one-upmanship is going on in central London, with green cars becoming a bit of a status symbol amongst affluent families.

Right now, Dell says buyers don’t put a low carbon footprint high on their house-buying wish lists. But she suspects this will start to change, making environmental upgrades a worthwhile investment. “I do think that people will start to place a value on a home which has low carbon emissions and is economical to run,” she said.

On November 23 the great and the good of the property, legal, and wealth management industries will gather in London for the Spears Wealth Management Awards 2021. Amongst them will be Black Brick’s own Camilla Dell, who has been nominated as Property Adviser of the Year for her work matching clients with their dream homes.

Black Brick had worked with this family 15 years ago, finding them an apartment in St John’s Wood. But, following the pandemic, they were keen to upsize and buy a property in the same area with outside space. Their budget was between £10m and £15m, but they were struggling with a serious lack of stock in the area, particularly in the sought-after east side of St John’s Wood, close to the High Street and Regent’s Park, where buyers will compete for the best houses.

We started working with our clients in April 2021, identifying three off market houses for them to see. They fell in love with one property, but its owners were not completely committed to moving on – and had nowhere else to live if they did. Our persistence and patience paid off and we successfully agreed the deal in October. The house was not only on prestigious street, but its low build style meant plenty of lateral living space. There was also off street parking and a garden, plus the added benefit of planning consent for an extension.

As well as negotiating the sale, we also sourced quotes from contractors so our clients had a clear picture of the cost and time frame involved should they decide to do the extension work. Relying on online searches to find your ideal home is risky in a market where supply is tight and there is a lot of competition. Our good contacts and reputation mean we get our clients access to the inaccessible.

Our young, British client wanted a three bedroom house in Notting Hill. He was looking for plenty of light, and a home in great condition which he could move straight into since he didn’t have the time or desire to take on any work. But the real problem was that he wanted a low-built house with plenty of lateral space, but most of the properties in the area are tall, slender townhouses.

We found our buyer a newly built three bedroom house with a 27 ft living room. The three storey house was wonderfully light and exactly what he was looking for and, since it was brand new, it was in immaculate move-in condition.

The market for houses in Notting Hill is very competitive right now but we were still able to negotiate a £195,000 discount from the reduced asking price – a saving which was far in excess of our fee.

Our client’s brief seemed impossible but our forensic approach to property search meant we still managed to identify the right house.

Our clients needed to find somewhere to live while they renovated their west London family home. They needed a property in good condition, had its own front door, and where they could bring their dogs.

We found a newly refurbished three-bedroom house on a gated mews in central Notting Hill with off street parking and a dog-friendly landlord.

The rental market in Notting Hill is low and stock and very competitive right now, particularly for larger properties. Through our extensive network of contacts, we managed to gain access to this house before it had been listed, and before any other potential tenants had seen it. We submitted our offer and secured the property entirely off-market, beating the competition in the process.

We would be delighted to hear from you to discuss your own property requirements. For a non-obligatory consultation, please contact us.