Many homebuyers are desperate to dive into the housing market, but it helps to keep your head amid the panic

With headlines proclaiming double-digit rises in house prices and predicting more to come, and estate agents ramping up interest with open days and sealed bids, it is little wonder some would-be buyers are panicking. Agents have reported properties attracting hundreds of viewings and tens of bids, and not just in London – homes in Cambridge, for example, are regularly going for £50,000 more than the asking price.

So, to paraphrase Kipling: how can you keep your head when all the buyers about you are losing theirs? Here are 10 things to consider before you rush to buy:

Your future plans

Before you buy, it’s vital to work out how long you think you’ll be able to live in the property. There’s no point trying to buy a studio flat if you think in a couple of years time you might want to start a family. Similarly, if your job or your financial circumstances are in any way unstable, ask yourself whether now is a good time to tie yourself to a location and the monthly commitment of a mortgage. If you buy the wrong place now not only could you quickly encounter the expense of moving again, if property prices fall you might find yourself forced to sell at a loss.

What happens if interest rates rise?

Interest rates have sat at a historic low for six years , but the general consensus is they will start to rise in spring 2015. As of mid-April, lenders will be stress testing mortgage applicants to check that they would still be able to afford their mortgage repayments if rates went up, but you too should consider the impact of a bigger monthly outlay. If rates go up, will repaying your mortgage mean you can’t afford any of the other things you like to do?

“If a relatively modest increase in interest rates would put your monthly budget under pressure then you should reduce the amount you are looking to borrow. At the very least, consider a fixed rate, perhaps over the medium term,” says David Hollingsworth from broker London & Country. Borrowing less will also allow you to access more competitive mortgages because your deposit will make up a bigger proportion of the purchase price.

The implications of your bid on your finances

Before you overstretch yourself to place the winning bid on a property – especially one at a high loan-to-value – it is vital to first assess the long-term impact of the sacrifices you will have to make. Are you truly ready for the commitment of such a large mortgage? What if house prices fall and you end up in negative equity? You will be stuck there, unable to sell? Will you regret your decision to buy in those circumstances?

“In my view, it’s much better to move to a cheaper, less popular area, than buy a property that means you can’t afford to go out or you risk losing your home,” says Kate Faulkner, MD of Propertychecklists.co.uk. “Make sure you have a back-up plan if prices fall. Check whether you could be prevented from letting the property by the lease or the terms of your mortgage, and that all your costs can be covered by the rent minus any tax you may have to pay.”

The hassle of homeownership

Owning your own home might seem like a dream come true, but if the boiler breaks down, the roof starts leaking or your new neighbours party every night till 3am, you may not find it quite so desirable. As well as the inevitable repair bills, there’s the fact it is not as easy to move if you decide you are not happy there.

Would a long-term tenancy make you feel as secure?

Renting for the long term tends to be viewed as much more attractive elsewhere in Europe, where tenants have greater rights. But it’s a mistake to assume that in the UK you cannot rent if all you want is security of tenure and a home that you can make your own.

“There are thousands of landlords out there who are interested in the security and stability of a long-term tenancy, and if you find one, you can often agree that you can decorate the property and make it feel like your home,” says Glenn Nickols from online tenant forum The Tenants’ Voice. It may even be possible to negotiate a cheaper rent if you are happy to rent the property long-term.

Widening your search area

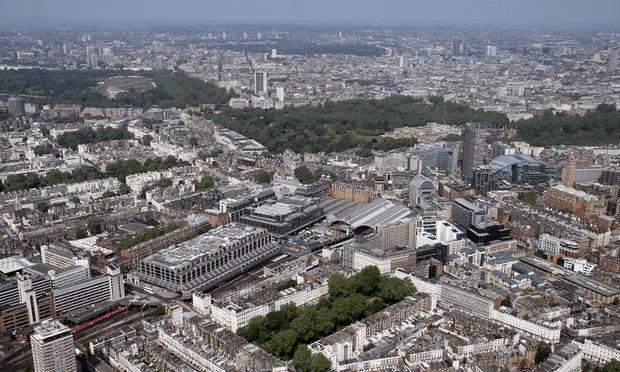

House prices in London are rising up to three times faster than house prices in northern regions of the UK, according to Nationwide. Could you include cheaper parts of the UK in your search? Even if you have to work in London, it’s worth considering whether you could afford to buy your dream home elsewhere and rent weekday lodgings near your office. Monday to Friday room rentals in central London (zone 1) start at just £400 a month and you can keep long-distance commuting costs low if you book train tickets in advance.

Cutting out the middlemen

The easiest way to beat the competition in a booming market is to avoid it completely. Try to find properties in your desired area that are not on the market yet. For example, look at properties that are being offered to let and consider making an offer. Alternatively, Faulkner advises “putting notes through doors so sellers can contact you directly”. You could also put a notice in local shop windows, papers and online forums as well as on social media. Search on Twitter for your desired area and ask locals to retweet a message stating what you are looking to buy.

What is happening to prices in your chosen neighbourhood?

“Research is key to keeping calm when entering the fraught house-hunting process,” says Nick Mead from The Buying Solution. “See as much property in your particular price bracket as possible and try to understand the prices achieved for comparable properties.”

Once you have figured out which postcodes you are interested in, set up email alerts on Zoopla and Rightmove, and create a spreadsheet that tracks how quickly these properties are selling and, ideally, the price they are achieving relative to the asking price. Why are some properties and roads less popular than others and are you willing to compromise when others aren’t?

Is your mortgage lined up?

To get ahead of the pack in a booming market, you need to have your mortgage in place, advises Nicholas Ayre, MD of home-buying agency Home Fusion. That way, when you come to make an offer, you’ll be able to demonstrate that you can move quickly and are a serious buyer. Typically, a mortgage agreement in principle lasts for six months and isn’t specific to any particular property. However, don’t panic and assume you have to stick with this deal if your bid is accepted. “It may be that another lender will have the better rates at this point,” says Hollingworth. He also warns against taking out a large number of agreements in principle in a bid to head off rate rises. “This can ultimately damage your credit score, as each agreement leaves a footprint on your credit file.”

Estate agents are there to get as much as possible for the seller

Obvious, but always worth remembering if you’re getting caught up in a frenzy of viewings. “We are increasingly seeing estate agents using open houses as a tool to try and achieve the highest possible prices for their clients,” says Caspar Harvard Walls from buying agency Black Brick. “The advertised price for the property is often artificially low to encourage as many buyers to view as possible, thereby creating a sense of high demand and multiple bids above the guide price.”

Some estate agents have even started charging buyers who make successful sealed bids a “finder’s fee”, usually 2-2.5% of the cost of the property. “Other agents try to use the current state of the market to blackmail applicants into seeing their in-house mortgage adviser, who in many cases only uses a panel of lenders rather than being independent,” says Ray Boulger from brokers John Charcol. It is against the law for agents to pressure you to accept the in-house broker, but try to stay calm and polite, even if you think the agent is trying to rip you off. “The more the agent likes you, the more support you’ll get when a choice has to be made,” says Mead.