The spectre of Corbyn may be laid to rest, but the threat of a mansion tax continues to haunt the streets of PCL as election chatter intensifies. Read the latest insights from some of the industry’s top names, including Aston Chase’s Mark Pollack, Black Brick’s Camilla Dell, Prime Purchase’s Charlie Wells, Winkworth’s Dominic Agace, Middleton’s Mark Parkinson & many more…

“Discussions around the general election have started to creep into conversations”, according to Christian Lock-Necrews, head of the Knightsbridge office at Knight Frank; following Labour’s strong showing at the local elections, and various manifesto murmurings, many other agents and advisors will be fielding questions about the possible impact of a change in government next year.

PrimeResi spoke to specialists from across the prime property sector to gauge the general feeling: what would a Labour-led government mean for the market, and which potential policies are keeping buyers and sellers up at night…

A Labour Government under the stewardship of Keir Starmer is less of a concern than it was under Jeremy Corbyn

Ashley Wilsdon, Head of London Buying, Middleton Advisors.

“The general consensus amongst our clients is that a Labour government is perhaps an inevitability at this stage…and with it a Mansion Tax of sorts is widely expected.

A Labour Government under the stewardship of Keir Starmer is less of a concern than it was under Jeremy Corbyn and the London property market seems to have already factored in this likelihood, which is reflected in lower levels of transactions compared to the same period last year.

The PCL London market will likely revert to type, namely vendors will be reluctant to sell and buyers will be opportunistic in their approach.”

Perhaps gives people who are on the fence a reason not to buy

Charlie Wells, Managing Director, Prime Purchase

“One hopes the reality of a Labour government, should we end up with one, will not be as negative for the top end of the property market as some fear.

There is talk of a percentage increase on stamp duty paid by foreign buyers in the UK – one hopes that the impact of that would be softened by the fact that the pound is relatively speaking pretty weak, although it has recovered a little, and UK property is comparatively not as expensive as property in some other countries.

That said, the uncertainty around a Labour government and what it might or might not introduce isn’t helpful; it perhaps gives people who are on the fence a reason not to buy.

One also has to question just how much such a move will actually generate for the economy. What impact will it have on the average working man? When rich people come to the UK and buy houses in London or estates in the country, they employ a lot of staff, as well as tradespeople, buy a lot of furniture etc and spend a lot of money in the economy. If we stop them doing that, is it worth it in order to generate an extra 2 per cent in stamp duty which grabs the headlines? Or is it just about appeasing the champagne socialists who live in Islington?

What Labour might not realise is that such policies have the potential to impact hard-working people in the UK. It may turn out not to be a very sensible move at all but quite often it’s not about that – it’s about appeasing the liberal elite.

It’s a similar situation with the plan to impose VAT on school fees – it won’t affect the rich, it will just put pressure on the state system as those parents who are only just able to afford to put their children through private school suddenly can’t do so. And what’s the outcome? More children in the state system and suddenly the local school’s class size goes from 22 to 30. What good is that to anyone?

The reality is that a Labour government probably won’t have as much of an impact as we think but it would put pressure on the ‘wrong’ people and certainly not those it is trying to target in the first place.

It’s certainly a talking point for clients. Are they worried? At the moment it is all an unknown and if they ask us what the impact of a Labour government might be, we can’t answer the question for them – they have to take a punt for themselves”.

Many people will see a change as welcome…but there could be more punitive measures around multiple home ownership

Mark Pollack, Co-founding Director, Aston Chase

“What a Labour-led Government would mean for the UK’s prime property market would depend on what legislation comes with a change in government. Fundamentally, Kier Starmer is reasonably moderate and it feels like there is an understanding that it would be an ‘own goal’ to punitively tax properties that could result in some wealthy people choosing to leave London despite them having strong ties to the capital such as children’s schooling and healthcare provision.

However, if there were to be a Labour-led Government, it would be a culture change, and there will be anxiety with any change of government particularly after such a long Conservative Government rule. However, we have had such a volatile time with the current government, so many people will see a change as welcome.

I believe under a Labour Government there could be more punitive measures around multiple home ownership. Some sort of wealth / property tax seems like a possibility and this will affect Buy-To-Let investors and multiple home owners such as landlords the most. However, under Labour Governments, there always tend to be an upturn in regeneration project initiatives and new development zone allocations. For example the regeneration of Nine Elms, Battersea Power Station and Croydon were all kick-started under Labour governments.

Labour Governments, historically, are happy for more private sale homes to be built, especially in London, as long as this comes with ample social housing, leisure and community infrastructure provision. Both the Labour and Liberal parties are currently very critical of the Conservative party that not enough new homes are being built in London and the wider UK, and a focus on more housing provision can only be good for the property industry.

We are not yet seeing any impact at the moment on buyers and sellers. We are potentially still 18 months away from a general election, in 2024 it may become a hot topic but at the moment we feel we have just begun to get over the effects of the mini budget and escalating interest rates, it would be nice to have a little bit of stability in the market for some time.

Also, especially in Prime Central London in locations such as St John’s Wood, Regent’s Park and Hampstead, the last 15 months have been a significant upturn in American families – both buying homes and renting. This is because of the exchange rate advantage, but also because the American real estate market has been so deeply depressed, so even if we have a change of political party, these overseas buyers and others from the Middle East and Asia are highly unlikely to “sell-up”.

Since the autumn mini budget it is only recently that we feel, perhaps as the weather is improving and spring has sprung, that despite interest rates going up, people have got used to the new terrain. There has been a period of inactivity resulting in pent-up demand but life goes on and people want to get on with things such as buying their new home.

Many of our recent sales are on properties that have been reduced in price – it has taken quite a long time for the market to get used to the new reality. Now that this has happened, and people have reduced prices, we are seeing a bit more of normality.

I am not sure that Labour is as such a terrible prospect for the property market as some view it, seeing as we have had a Conservative Government that has been so set on financial acumen and everything associated with that. So we are currently not as phased by this as we have been with other political issues”.

London will undoubtedly remain a desirable city for prime buyers

Toby Downes, London Specialist, Haringtons

“Of course, for many looking to buy or sell prime residential property in London, the prospect of a new Labour government does prompt concern. Higher stamp duty rates aimed at the International buyer combined with further measures being discussed could discourage purchasers and temper their appetite for the Capital. However, London has long been a favourite with overseas buyers whose interest remains strong most recently fuelled by the strength of dollar based currencies.

Regardless of the political agenda, safety, security, culture and a favourable time zone, ensure that London will undoubtedly remain a desirable city for prime buyers. Little surprise therefore that with fewer excellent properties available, impartial advice and buying expertise are today more crucial than ever”.

What the London property market needs is more affordable stock, not higher taxes

Camilla Dell, Managing Partner, Black Brick

“A Labour win isn’t going to have a positive impact on the super prime London property market. Labour want to increase tax on overseas buyers which is already at 15%, an extortionate amount. Most overseas buyers aren’t even competing with first time buyers as they are buying well above £1 million. What the London property market needs is more affordable stock, not higher taxes. Higher stamp duty will cause the market to stall meaning fewer transactions, but not necessarily huge price falls.

The last time stamp duty went up the London market fell pretty much in line with the increase. How much the market falls this time all depends on what the extra increase looks like. A 60% tax, such as what the Singapore government have brought in for overseas buyers, would be disastrous and would erode confidence in the market in London. Right now, most overseas buyers are unaware of the changes a Labour government would implement if elected but I imagine that will start to change as we get closer the GE”.

Those who really want to have a foothold in one of the pre-eminent cities in the world will still want to be here

Caspar Harvard Walls, Partner, Black Brick

“The changes to taxation on property over the last 10 years and in particular to stamp duty has had many impacts, one of them being that buying in London has to be for the medium to long term.

A change in Government might put off some buyers but Governments potentially change every five years and so those who really want to have a foothold in one of the pre-eminent cities in the world will still want to be here”.

Buyers and sellers are understandably craving political stability

Jimmy Waight, Regional Director, John D Wood & Co

“After the disastrous mini-Budget announcement in autumn 2022 which sent mortgage rates spiralling, and spread a cloud of uncertainty across the property market, buyers and sellers are understandably craving political stability.

The market has settled, and confidence has begun to return, however, we need our elected Government to take our housing policy with the seriousness it deserves.

There are serious challenges facing the UK’s housing market – from lack of affordable homes, and rising rents, to uncertainty around policy, such as the u-turn on the abolishment of the leasehold system – to name a few. It is abundantly clear that we need a long-term strategy to address these issues, which will create much needed improvement within the industry. Having had 6 housing ministers in the last 15 months, and 16 housing ministers over 13 years, it comes as no surprise that these issues are yet to be resolved.

Regardless of which party is in power and the merry-go-round of housing ministers, the prime London property market remains resilient and an upcoming election is unlikely to deter people who need to move home”.

Our current crisis is in development and construction

Ben Ridley, Director, Architecture for London

“A Labour government would result in shifts in housing policy that are likely to affect the prime property market. Labour intend to increase the stamp duty paid by foreign buyers of UK properties, thereby reducing demand from overseas buyers, this will have a cooling effect on value growth in the prime sector. Other proposed policies that may have a similar effect include: allowing only first-time buyers to be able to buy homes in a new development in the initial months of marketing, and limiting overseas buyers to 50% of units in any new development. The benefits of these policies will be meeting local housing needs first and potentially making properties more affordable to local buyers.

I feel that our current crisis is in development and construction. Site transactions and development activity are being paused due to the double-edged sword of high borrowing and construction costs, both arguably due to political decisions in recent history. I think over the next few years we will see an impact from this reduced supply of new homes in the prime sector – this reduction in supply may keep prime values buoyant despite the policies of a potential new government”.

If Labour pushes them too far, international investors will choose other cities to the detriment of the economy in London and UK as a whole

Dominic Agace, Chief Executive, Winkworth

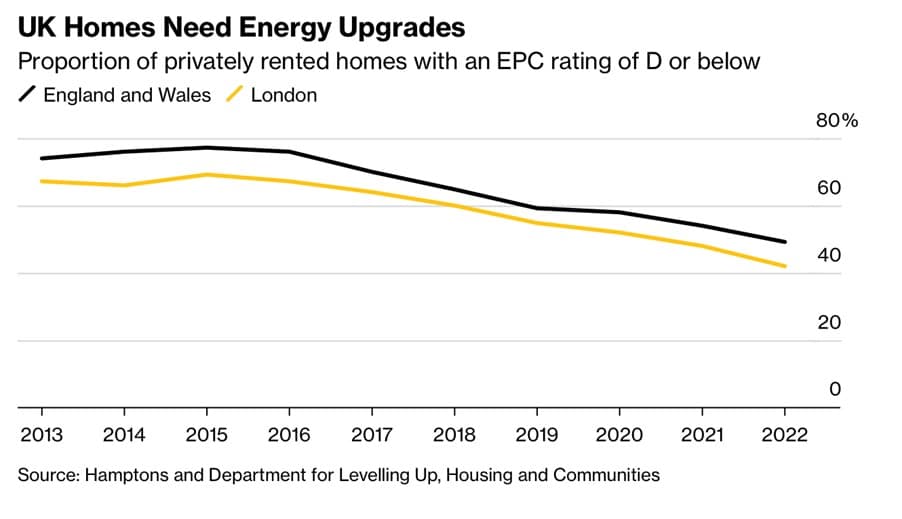

“The outlook for prime markets looks more positive than it has for some time, with Brexit behind us and Labour taking a more centrist approach than they have in the past. However, the housing market is in crisis, with rents rising rapidly recently after a sell-off by landlords in the face of tax changes. A lack of new homes being built is set to exacerbate structural supply and demand issues for the foreseeable future. With these issues, housing has never been such a political issue. With that comes the dangers of over-intervention having unintended consequences that add to the problem rather than solve it.

In some ways both parties are now trying to occupy the same ground, competing for the votes of the first-time buyer and generation rent with proposed incentives for FTBs and further regulatory reform to support tenants. In many ways, a Conservative or a Labour government will have the same impact as they push through these agendas, as we start the countdown to the next election and the parties seek to win votes – with the housing market at the core of their pitch to the electorate.

The dangers are already here and it now depends whether a Labour government will exacerbate them. Support for first time buyers is a positive step, but without actual action on supply and planning reform, this will be a one hit wonder – with future first time buyers facing an even steeper challenge. The Conservatives have clearly defeated themselves by missing their housing targets. Labour have spotted this opportunity and are pushing their commitment to build new houses and council houses, which one can only hope they deliver if they come to power.

The big concern is the private rental sector where private landlords are starting to not see a future with rising costs of finance and tax changes meaning they pay tax on income they do not receive and their investments are underwater. The issue is if they do sell off, then rents will rise further and competition will increase. The answer to this is not rent caps. We have seen in Scotland how this will disincentivise investment in the sector by institutions or private landlords, affecting the availability for people who want to live near their workplaces. This is undermining the appeal of our cities as places to move for career reasons. In the case of London as a global business centre, international workers coming to the capital for work can’t find accommodation. We need to encourage a healthy private rental sector to ensure that young people can live in cities, and not force them all into larger rental schemes without offering the choice of more central locations. We do need both options and responsible regulation to ensure a fair market place.

The other threat for prime markets is a stated intent to increase tax on overseas investors. We have seen in recent years that tax changes and economic credibility do affect buyer demand in prime markets. London needs to continue to be open and welcoming to overseas investors to continue to thrive. If Labour pushes them too far, international investors will choose other cities to the detriment of the economy in London and UK as a whole”.

A Mansion Tax as such still looks difficult, if not impossible to implement in an equitable way

Mark Parkinson, Managing Director, Middleton Advisors

“The short answer is we do not know as they have not published any policies. If a recent article citing a Labour think tank on possible/probable housing policy is correct, it seems to be more focussed on helping first-time and low-income buyers get on the ladder with government backed mortgages etc, rather than clobbering the owners and buyers of prime property. They did suggest further increased SDLT for foreign buyers, but it would be quite difficult to define a ‘foreign’ buyer given the very diverse nature of London as a city.

One question we are asked increasingly is about the threat of a Mansion Tax. This was a recurrent theme in the run up to the 2019 General Election and the thinking remains the same. There may well be increases in Council Tax at the higher end or indeed more Council Tax bands, but a Mansion Tax as such still looks difficult, if not impossible to implement in an equitable way”.

A new government could provide further stability

Jonathan Harris, Founder, Harris Associates

“London remains a safe harbour for investors, regardless of the government in power and despite economic concerns, we see reasons for optimism. The UK market exhibits relative resilience in the face of global instability and unpredictability, which is why it has and will continue to draw the appetite of international investors, including Asian capital. We see this demand through our international partnership with Edmund Tie.

As it stands, the local councils that are mostly Labour-led would suggest minimal market changes. On a macro level and looking back at Labour’s previous tenure, their investor-friendly approach and openness to immigrants bode well for business, hospitality, and real estate. With the market already showing signs of strength, a new government could provide further stability”.

There is a lot of pain coming for lots of people

Yasmin Ulhaq, Director and Founder, Glenfield Property Management

“As the general election approaches, housing plans have once again taken centre stage. The Conservative Party, in my opinion, has heavily focused on the Renters Reform Bill (RRB) as a key solution. However, I anticipate several challenges in its implementation. The RRB was initially discussed in 2019 but has faced delays due to uncertainty within the party. The legislation aims to abolish the section 21 notice, shift tenancies to periodic terms, and introduce new standards for the rental sector making it challenging for the private sector landlords.

Labour has shown support for rent controls, particularly in major cities. If implemented, this could potentially impact the rental market and, indirectly, the prime property market by affecting rental yields and returns on investment for landlords. According to Nandy, the next Labour government will never treat renters like second-class citizens. What about Landlords? I believe both parties have totally misjudging the situation. By protecting tenants they are actually causing more hardship for them. This is going to increase rental prices making it harder for tenants to rent and subsequently landlords will leave the sector. What about having some practical landlord incentives?

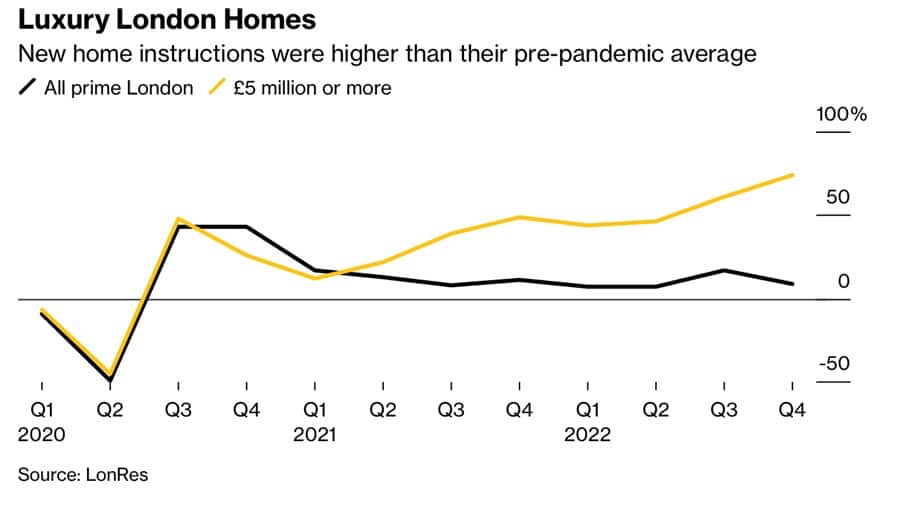

The global community of super prime buyers (anyone over the £5mn category) are more diluted now as other cities such as Dubai, Spain and Miami have entered the stage. London properties are set to have the most substantial fall in value during 2023. Several signs have indicated towards the Labour party increasing the stamp duty paid by foreign buyers of UK property as well as limiting the sale of new build buyers overseas. Starmer wants to retain up to 70% allocation for UK buyers. Starmer is making an exception here by bashing the uber wealthy, especially those who claim non domicile status.

Speaking to some of our clients, their tax advisers are on the fence and are considering diverting their money elsewhere, potentially leaving a gap in the UK’s finances. Many landlords have decided to exit the rental market and invest in other funds. Will the government build the 300,000 homes it’s promised in time before we have another crisis on our hands. There is a lot of pain coming for lots of people”!

Targeting of ‘overseas’ buyers as a solution is problematic…and rather short-sighted

Vic Chhabria, Founder and CEO, London Real Estate Office

“The Labour party has already sent clear signs they are keen to limit non-dom buying activity with a second stamp duty surcharge and even sales restrictions on new build developments, which is significant to the prime property market. Of course, there is a need to make homeownership more accessible though this targeting of ‘overseas’ buyers as a solution is problematic and – dare I say it – rather short-sighted. Such a blanket approach to the UK’s entire market, and all people of so-called international status, doesn’t reflect the complexities and nuances within it and it’s hard to say whether such actions will really bring about the change that assists local and younger buyers. It also assumes international buyers are not active residents and contributors to the local communities and economies in which they live, from local businesses, schools, gyms, restaurants, bars and more. If the above would come into force, the Capital could lose out on foreign money that has historically been crucial to the UKs economy. This in turn could be a hit to our current political-economic climate and could result in worse outcomes, with little help to the audience it’s aimed at assisting.”

As it stands there is caution amongst both UK and overseas buyers but not worry. If a Labour Govt looks is imminent, it could potentially catapult London’s property market between now and the election as foreign buyers look to snap up homes in the Capital before any stamp duty surcharges and restrictions come into play”.

By Zoe Dare Hall

By Zoe Dare Hall