2nd February 2023

8mins

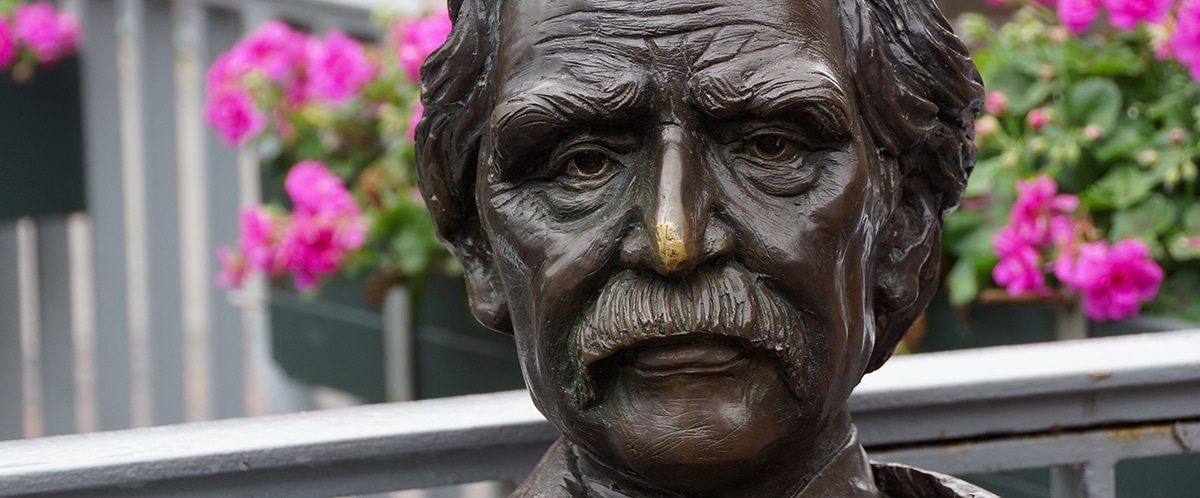

When rumours that he had passed away brought reporters to the doorstep of American writer Mark Twain his response was brief and to the point. “The report of my death was an exaggeration,” he said.

The author of the Adventures of Tom Sawyer comes to mind when considering the current state of the property market. Last year, most pundits were in agreement that prices would plunge during 2023, with a worst case scenario of a 20% plunge suggested by Capital Economics.

And yet 2023 has begun with a surprising burst of optimism. Buyers have recovered from the shock of the mini budget, and are feeling more hopeful about Britain’s economic prospects.

It would be premature to dismiss all those reports of a property downturn as an exaggeration. But there is also reason to hope that they could be.

Buyer sentiment plays a remarkably strong role in whether a housing market flourishes or flounders. And over the past few weeks that sentiment has been extremely upbeat.

Knight Frank reports that its central London offices received more offers during the third week of 2023 than they had seen “for decades” in the traditionally sluggish January market.

And the number of new prospective buyers registering in the first three weeks of the year was six per cent higher than in 2020, during the “Boris Bounce” that followed the December 2019 election and rapid exit from Europe.

“We have taken 60% more new buyer enquiries during January 2023 compared to the same time last year, which suggests a potentially busy year ahead,” agreed Camilla Dell, managing partner of Black Brick.

“I definitely think that there is a lot less doom and gloom than there was last year in the aftermath of the mini budget. People feel that inflation has peaked, and mortgage rates are looking more sensible.

“I think that there are definitely green shoots of hope.”

At Black Brick, new buyer interest has mainly been from Middle East, specifically the UAE and the UK. Buyers from the USA, Bermuda, and Oman are also active and now that Beijing has opened its borders, some estate agents are reporting a new wave of interest from China too.

“They want everything from two bedroom pied a terres at £2m all the way up to clients relocating and buying £15m to £50m family homes,” said Dell.

When it comes to UK buyers, Caspar Harvard-Walls, a partner at Black Brick, notes a real sense of urgency in the market. “What we are hearing from agents is that their buyers are really focussed,” he said. “Some of them are keen to be able to use mortgages they have had agreed at lower rates than they would get now.

“We also still have a hangover of people who have not moved house for a very long time, first because of Brexit, then the pandemic, and they are now just feeling it is time.”

Asking prices across most of the capital were stagnant over the Christmas period as vendors tried to align themselves with the expectations of the market.

But there are exceptions to most rules, but in the capital, prices continue to rise in three boroughs.

In Tower Hamlets, home of Canary Wharf, hip East London and the City fringes, asking prices increased 1.1% between December and January according to Rightmove, to an average of just below £600,000.

“People are starting to feel they need a home in the city centre again because they have gone back to the office and the transport infrastructure has just crumbled post-Covid,” said Harvard-Walls. It is just shocking at the moment, and becoming really untenable for some people”.

Asking prices are also up – albeit marginally – in Hammersmith & Fulham and Camden. These boroughs are home to some of the capital’s most sought after urban villages, from Hampstead and Primrose Hill to Ravenscourt Park and Fulham. These locations are hugely popular with parentally-assisted first time buyers who want easy access to central London plus plenty to do on the doorstep. Families also love their green space and good schools.

“What strikes me is that these are good, safe areas,” said Harvard-Walls. “You are not trying to find the next up and coming neighbourhood.”

Another more micro location attracting strong interest, said Dell, is Mayfair. “We are still very, very busy with buyers looking for holiday homes. In times of global uncertainty, there is always a flight to quality and Mayfair has benefitted a bit from that. People feel really safe buying property in Mayfair.

“Also Mayfair has really come into its own as the leading area within prime central London and there is very limited supply on the market.”

As borrowing has become more expensive over the past few months, increasing numbers of London buyers are choosing to pay in cash for their property purchases.

And the advantages of this strategy go beyond sidestepping the issue of rising interest rates.

Many vendors will place significant value on securing a cash buyer for their property, particularly in a market currently riven with down-valuations and fall throughs – and may even accept a lower offer for their property if the buyer is able to pay in cash.

“Because finance is not as cheap as it was, many clients are opting not to use it,” said Dell, who reports that around half of Black Brick’s clients now pay in cash, up from an average of 20% in previous years. “Cash buyers have always had an advantage because they can move quicker and they are a sure thing, so vendors are always more amenable to some negotiating”.

“It is a buyers’ market at the moment and being a cash buyer means that you have a better chance of getting a better price agreed.”

According to data from Savills’ own deal book, some 65% of its buyers in prime central London pay cash. Almost six in ten buyers in north and east London are cash buyers, as are almost half of its north west London buyers. This figure falls to around one in three buyers in west and south west London.

After a year of phenomenal growth and such a dire lack of supply that would-be tenants were forced to bid for homes to rent, new evidence suggests that London’s rental market is entering a period of relative stability.

According to property consultancy JLL achieved rents in prime central London in the last quarter of 2022 were 6.1 per cent higher than they were in the same period of 2021,

However Marcus Dixon, director of UK residential research at JLL, notes that the rate of growth is slowing.

A similar picture is emerging in London’s mainstream rental market. While asking rents hit a record £2,480pcm in January, according to Rightmove, the supply of available homes has started to slowly increase which should anchor rapid price growth this year.

Despite rising rents and strong demand, Dell said small time investors who might once have used a couple of rental properties in London as part of their pension planning have been priced out of the market by a combination of higher interest rates and fewer tax breaks. “There is still investment appetite in London, but it has diminished,” said Dell. “Our investment clients tend to be bigger, and by that I mean spending more so they can structure themselves properly and buy in bulk, thereby still benefitting from lower tax rates. The returns are not that attractive in terms of yield, but the buy-to-let market still appeals to cash buyers or conservatively leveraged buyers who can still get a return and are looking at London property as a long-term hold. If you are a wealthy individual making your wealth in a high risk emerging market, London property is still a good diversifier”.

Black Brick’s Camilla Dell and Caspar Harvard-Walls have both been included in this year’s new print edition of The Spear’s 500, an essential guide to the best advisors to high net worth clients, from buying agents to lawyers and equestrian specialists.

Dell earned her place on the list thanks to her “total dedication to her clients’ needs and her expert negotiation skills”.

Harvard-Walls, meanwhile, has “gained a reputation for going the extra mile for his clients”, and has bought more than £500 million worth of property on behalf of his clients over the past 16 years.

We would be delighted to hear from you to discuss your own property requirements. For a non-obligatory consultation, please contact us.