A record 104,794 home sellers slashed their prices last month. Could the Bank of England’s base rate cut today signal future falls in mortgage rates and offer a lifeline?

By David Byers

The spring housing market is traditionally a hive of activity, with homes flanked by gardens of tulips and daffodils flying off estate agents’ shelves like hot cakes.

However, this spring has been a season of two drastically contrasting halves. After a frenetic start in March, when buyers set new records for deals done and mortgages taken out, it all went very quiet in April and sellers have been left pleading for attention since.

In early spring, before the cheaper rate of stamp duty expired on March 31, there was a flurry of activity, as buyers — particularly first-timers — desperately rushed to complete their purchases, trimming an average of £6,000 off their tax bills in London and the southeast.

As a result of this stampede, the number of house sales rose to a record of 177,370 in March, up from 109,700 in February — and more than double the 86,810 total recorded in March 2024 — according to HMRC. There was a surge in mortgage borrowing, up from £3.3 billion in February to £13 billion in March, while stamp duty receipts for a gleeful Treasury in the first quarter of this year were £2.595 billion — the third quarter in a row when they were above £2.5 billion.

After this rush, as the calendar ticked over to April Fool’s Day, the dust settled — and, for many sellers, it has been tumbleweeds all the way since as they struggle to find buyers for their homes.

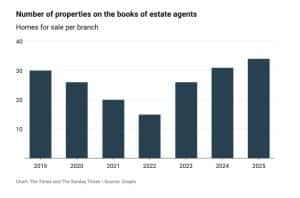

The property portal Zoopla reports that there were 15 per cent more homes for sale in April compared with the same time last year, but only 1 per cent more buyers. The average estate agency, meanwhile, has 34 homes sitting on the market — the highest number in any April since 2019.

As a result of this buyer desert, many sellers are taking urgent action. Data given to The Times by TwentyCi, the analytics company, shows a record 104,794 sellers reduced the price of their properties last month, which is higher than all prior Aprils going back to 2019.

At the height of the Covid boom, when buyers were flocking to the market amid the April 2021 stamp duty holiday, only half as many — 51,376 — needed to cut their prices because there were so many more buyers around.

All of which means that this spring there will be a simple mantra for many sellers, particularly in more affluent areas, where prices (and therefore stamp duty) are higher: cut your prices or have your home languish. As Simon Gerrard, chairman of Martyn Gerrard Estate Agents, says: “The stamp duty changes have had an immediately chilling effect on the market.”

And yet it isn’t all bad news. With today’s cut in the Bank of England base rate of interest from 4.5 to 4.25 per cent, mortgage rate cuts look likely to accelerate across high street lenders in the coming weeks, potentially luring buyers back to the market and providing some desperately needed attention for those neglected sellers.

Here’s what you need to know about the strangest spring market in recent years.

The spring where only certain areas are in bloom

As March ticked into April and stamp duty rose, data provided toThe Times shows the huge extent to which the UK’s housing market cooled almost overnight. PropCast, a data platform that produces weather forecast-style heat maps for every area of the UK, shows the number of “hot” markets — where more than 35 per cent of properties listed for sale are under offer — shrank from 1,730 in March to 1,678 in the space of a month.

However, the regional variations are greater than ever. On the one hand, some areas in the southeast, southwest, east and London — where buyers are most affected by rising stamp duty and where international residents worried about higher taxes are selling up — are getting much chillier. For example, the SW10 postcode (covering West Brompton and part of Chelsea) has a paltry 11 per cent of advertised properties under offer, and Marylebone, Mayfair and Fitzrovia (W1), which has been particularly badly hit by foreign owners selling up, records only 9 per cent.

Camilla Dell, of Black Brick, a buying agent that sources properties at the most expensive end of the market for wealthy buyers, says the impact of Labour’s tax rises — and in particular the end of the non-dom scheme — is hobbling the priciest parts of London: “Buyers of prime London property are nervous about buying into a market with excessively high stamp duty rates and an exodus of wealthy people leaving our shores for more favourable tax jurisdictions.”

Areas in coastal resorts and beauty spots are also getting chillier, as rising taxes and running costs price out second-home buyers and holiday let investors. In TR8 (Mawgan Porth, Cornwall) only 25 per cent of advertised properties were under offer in April. In Windermere (LA23) it was 23 per cent.

By contrast, property markets in northern areas — where large numbers of homes remain beneath the stamp duty threshold (of £250,000 for home-movers and £425,000 for first-time buyers in England) and are popular with investors and first-timers — are still booming. For example CA1 (Carlisle) and SK3 (Stockport) both have 73 per cent of homes on the market under offer.

Reflecting this extraordinary divide, Edward Hartshorne, managing director of Blenkin & Co, an agency in York, says: “March and April saw some of the best trading months in our 33-year history.”

Selling a property in a cold area? Here’s what to do

“Many sellers have just not grasped that we are in a very challenging market, and have not adapted accordingly,” Marc Schneiderman, director of Arlington Residential, says.

Jamie Hope, managing director of Maskells, agrees: “This is a price-critical environment. We recently agreed to the sale of a good house that, at the initial asking price, saw no offers. The price was reduced and, within two weeks, three buyers competed and the house is now under offer close to the original asking price.”

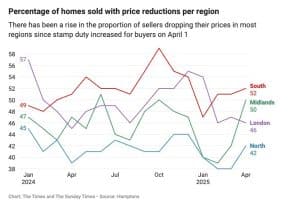

There is early evidence that sellers in most areas are indeed dropping their prices meaningfully, according to Hamptons, the estate agency. It found that across Britain, nearly half (48 per cent) of homes sold in April were reduced in price, up from 45 per cent in January, February and March this year. This ranges from 52 per cent of sellers reducing prices in the south to 42 in the north.

However, the average number of homes on agents’ books is still the highest in recent years, at 34 properties per agent, according to Zoopla, which suggests more price cuts are needed.

Ultimately, sellers need to familiarise themselves with the picture in their area and act accordingly.

Light at the end of the tunnel — as mortgages become cheaper and easier to get

In the short term Gerrard believes the sluggishness in parts of the market will continue. “It’s likely that these [stamp duty] changes will act as a persistent brake on transactions,” he says. Indeed, data released last week by Nationwide showed national prices down 0.6 per cent month on month, reflecting that trend, although Halifax recorded a modest 0.3 per cent rise in figures out on Thursday.

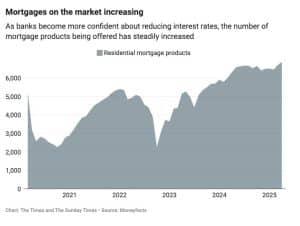

Yet the evidence is that in areas hit the hardest by rising taxes there might be the prospect of a brighter summer ahead as borrowing becomes cheaper. The Bank of England cut interest rates today in the first of what is likely to be a series of back-to-back rate cuts that could result in them falling by as much as one percentage point over the next six months, City analysts believe.

This will particularly help buyers in pricier southern areas, who are struggling to afford the loans needed to meet more expensive house prices. The number of mortgage products being offered by lenders has steadily gone up in recent weeks as rates have reduced. And lenders are being asked by the financial regulator to be more generous on affordability calculations to allow more people to borrow.

Look around, buyers: there are new-build deals to be had

However, if you’re a buyer and fear your stamp duty bill will price you out, rest assured there are people even more desperate than you — new-build developers.

Builders are suffering a double whammy, with high taxes putting off prospective buyers who were, in many cases, already deterred by the end of the Help to Buy scheme, which until 2023 used to provide loans of up to 40 per cent to first-time buyers to buy new-builds.

Now, many developers are desperately trying to compensate with lucrative incentives to cancel out tax rises. Peabody New Homes, for example, will provide up to £11,250 to buyers at its developments including Higgs Yard at Loughborough Junction, southeast London, where properties start at a pricey-looking £424,000 for a one-bedroom flat.

Another developer, Backhouse, is offering an incentive of £10,000 to buyers purchasing in their Cotswolds developments at Blunsdon, Highworth and Moreton-in-Marsh.

Barratt, another developer, has launched a scheme called Starter Deposit Match, in which the developer will add 5 per cent on top of any 5 or 10 per cent deposit raised by a buyer. Meanwhile, NHG Homes is offering £5,000 cashback on one-bedroom apartments at the Perfume Factory, where prices start from £435,000, but where buyers can buy slices of a home under the Shared Ownership scheme (read the smallprint carefully before entering into such arrangements). Lovell Homes is offering to pay stamp duty on its flats at Trinity Park in Woolwich.

So, for cash-strapped buyers looking for money off a newbuild — or hunting for a bargain as desperate sellers drop their prices — this could counterintuitively be a time of opportunity. “There are some clear buying opportunities,” Robin Chalk, of the agency Anderson Rose, says. “Spring is a season of contrasts, after all.”